- Maintained strong operating performance with total income of AED 8.9 billion (+4% QoQ) and net operating revenue of AED 7.1 billion (+5% QoQ).

- Pre-impairment profit at AED 5.3 billion increased by 10% YoY and profit after impairment and before gain on bargain purchase at AED 3.1 billion increased by 44%.

- 19% QoQ jump in net profits to reach AED 3.1 billion on the back of improving economic conditions.

- Sector leading cost income ratio of 26.2% as cost synergies continue to realize.

- Foreign ownership limit increased to 40% guided by strong DIB global investor demand.

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE and the second largest Islamic bank in the world, today announced its results for the period ending September 30, 2021.

9M 2021 Highlights:

Sustained sequential growth in profitability supported by disciplined cost management and lower impairments:

- Total income increased by 4% QoQ to reach AED 8.9 billion YTD.

- Robust growth in net operating revenues of 5% QoQ and 3% YoY which now stands at AED 7.1 billion YTD.

- Continued reduction in operating expense, down by 12% YoY from AED 2,134 million to AED 1,874 million as investments in digitalization as well as synergies from acquisition continue to realize.

- Profits before impairments of AED 5,275 million up 7% QoQ and 10% YoY.

- Impairment losses of AED 2,174 million lower by 10% QoQ and 18% YoY.

- Net profits maintains its improving trend over the past few quarters with a 19% QoQ jump to reach nearly AED 3.1 billion YTD supported by effective cost management and lower impairments.

Maintained a robust balance sheet with healthy liquidity and improved capitalization:

- Earning assets remained stable with net financing and Sukuk investment at AED 232.7 billion despite significant corporate prepayments which were offset by gross new financing of nearly AED 30 billion YTD.

- Customer deposits improved by 4% YTD now at AED 214.1 billion with CASA stands at 39% amounting to AED 83.9 billion during 9M 2021.

- Liquidity remain strong with finance to deposit ratio of 90% and LCR of 160%.

- Balance sheet remained stable with total assets now at AED 289.4 billion.

- Continued healthy QoQ improvements on ROA and ROE now at 1.4% (+10 bps QoQ) and 10.9% (+50 bps QoQ) respectively.

- Capitalization levels increased with CET1 at 12.8% (+50 bps QoQ) and CAR at 17.5% (+50 bps QoQ), well above the minimum regulatory requirement.

- Total equity now stands at AED 40.6 billion.

Management’s comments for the third quarter ending September 2021:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank

- The economic recovery of the UAE remains on track with strong performance of the non-oil sectors driven by improving demand of business activities and rising consumer confidence that is supported by high vaccination rates of the domestic population. The successful opening of the World EXPO has demonstrated the nation’s ability to quickly recover from the global pandemic with all key economic sectors geared towards supporting this major event. DIB remains at the forefront of helping businesses as well as government entities deliver a truly remarkable global event.

- The UAE banking sector has remained resilient with healthy liquidity, strong capital buffers and improving profitability since the start of this year. DIB’s net operating revenues has reached AED 7.1 billion, a robust growth of 5% QoQ and 3% YoY on the back of improving economic conditions and the gradual return of business activities.

Abdulla Ali Obaid Al Hamli, Board Member and Managing Director:

- The various structural reforms on employment and residency has made the UAE amongst the top preferred city to live in globally. With the introduction of strategic economic programs to coincide with the nation’s golden jubilee, Dubai is headed towards the fastest pace of recovery throughout this pandemic that any country has seen globally.

- Our funding sources and liquidity continue to be a key strength of the bank with customer deposits now reaching AED 214 billion, a robust growth of 4% YTD primarily supported by the wholesale business representing more than 50% of the deposit base. LCR ratio now stands at 160% up from 129% at YE2020.

Dr. Adnan Chilwan, Dubai Islamic Bank Group Chief Executive Officer:

- The UAE recovery momentum continues to accelerate following the successful regulatory measures supported by economic stimulus of more than USD 100 billion, high oil prices and a targeted implementation of a robust vaccination campaign nationwide. Aligned to the positive trend, DIB’s business direction mirrors that of the nation with a strong sequential quarterly growth in total income reaching AED 8.9 billion (+4% QoQ) and net profit of AED 3.1 billion (+19% QoQ) supported further by renewed business optimism with the successful opening of the World EXPO.

- The steady improvement in our profitability is supported by our consistent efforts to continue to extract synergies from the acquisition, whilst pushing for further efficiencies via our digitalization drive and further optimization of our branch and ATM network. Evidence of the success of our cost management approach is clearly visible with OPEX reducing by a considerate 12% YoY to reach AED 1.9 billion thereby leading to one of the lowest cost income ratio in the market at 26.2% (lower by 320 bps YTD).

- Liquidity remains robust as always with Finance to Deposit Ratio at 90%, while capital and profitability remain strong with all key metrics seeing steady sequential QoQ improvements on ROA and ROE now at 1.4% (+10 bps QoQ) and 10.9% (+50 bps QoQ) respectively as well as capitalization levels with CET1 at 12.8% (+50 bps QoQ) and CAR at 17.5% (+50 bps QoQ).

- As the UAE aims to transition towards the green economy, we remain committed to and fully aligned with the nation’s sustainable ambitions on energy, climate and the society and our future strategic direction will see the bank taking key and decisive steps to protect the future of the nation and the world in line with UN SDGs.

- Whilst the economic recovery continues, our prudent approach to growth and profit protection saw us strengthen our fixed income book with Sukuk investments now reaching AED 40 billion from AED 35 billion at the start of the year depicting a solid growth of 13% YTD and 8% YoY. This portfolio primarily consists of sovereigns and financial institutions and the strategic growth is in line with our objective and focus on extending business in low risk sectors.

Financial Review

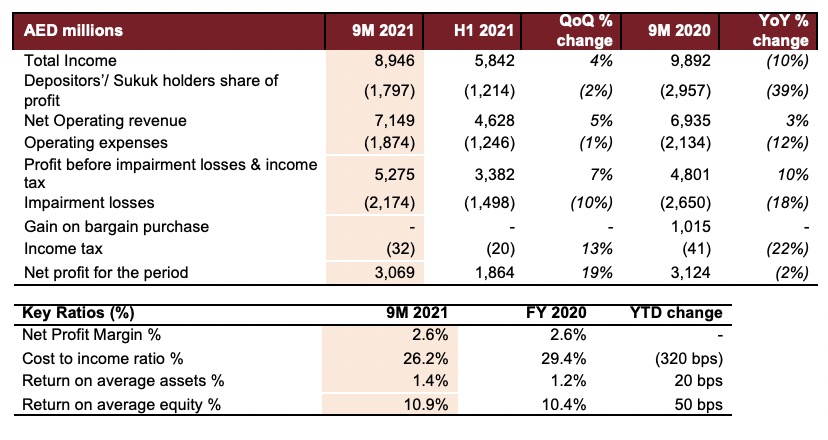

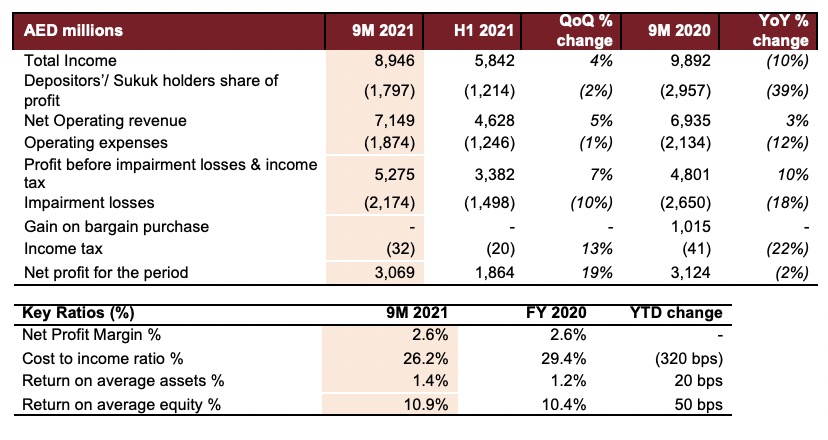

Income statement summary:

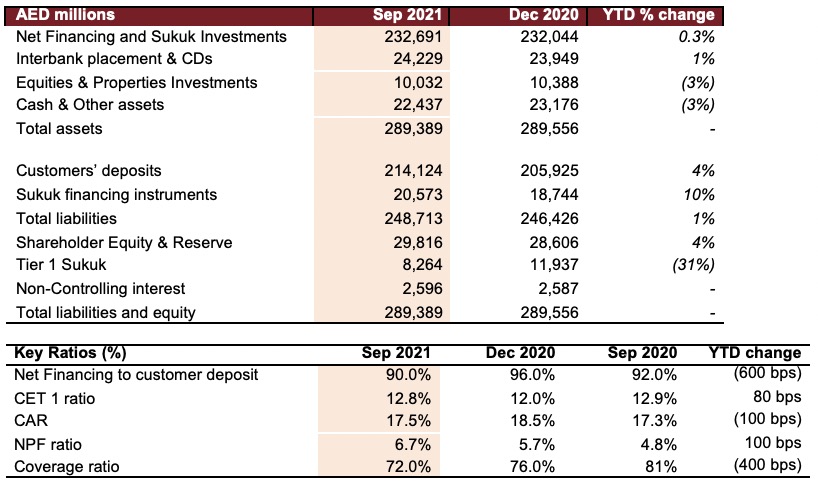

Balance Sheet Summary

Operating Performance

The bank’s total income during the first nine months of 2021 reached AED 8,946 million depicting a sequential growth of 4% QoQ. Effective stimulus measures and a rapid economic recovery have also contributed to the continued sequential growth of total income over the past few quarters. Net operating revenue, also saw a growth of 5% QoQ and 3% YoY now reaching AED 7,149 million.

Operating expenses improved to AED 1,874 million compared to AED 2,134 million in the same period of last year, an improvement of over 12%. The lower expenses have led to an improvement in cost to income ratio by nearly 320 bps year to date, which now stands at 26.2% vs 29.4% for FY2020, clearly a leader in the market on this metric.

Pre-impairment profit during the first nine months of 2021 saw a robust increase of 7% QoQ and 10% YoY reaching to AED 5,275 million compared to AED 4,801 million in the same period of last year. Impairment charges declined by 18% YoY to AED 2,174 million.

The Net profit of the bank rose to AED 3,069 million following a strong 19% QoQ growth in line with improving economic conditions.

Net profit margin steady QoQ to reach 2.6% (+6 bps QoQ) despite the low-rate environment.

ROA and ROE remain healthy at 1.4% and 10.9% respectively.

Balance Sheet Trends

Net financing & Sukuk investments remained stable at AED 232.7 billion in the first nine months of 2021. Sukuk investments now stands at nearly AED 40 billion depicting a solid growth of 13% YTD. Gross new consumer financing amounted to more than AED 10 billion during the first nine months of 2021 driven by strong growth in home and personal finance while another nearly AED 20 billion came from corporate.

Customer deposits grew to AED 214.1 billion year to date, from AED 205.9 billion at year-end 2020 reflecting a robust rise of 4%. CASA stands at AED 83.9 billion representing about 39% of customer deposits. Liquidity coverage ratio (LCR) at 160% remains well above regulatory requirement with finance to deposit ratio of 90% depicting healthy and comfortable liquidity position.

Non-performing financing (NPF) ratio now stands at 6.7%, adequately covered by cash coverage ratio at 72% and overall coverage including collateral at 103%. Cost of risk on gross financing assets continue to be on a downward trend and now stands at 101 bps compared from 137 bps in year-end 2020 an improvement of 36 bps to date.

Capital ratios continue to improve with CAR ratio now at 17.5% and CET 1 ratio is stable at 12.8%, both well above the regulatory requirement.

Key Business Highlights

- DIB has successfully executed the increase in its Foreign Ownership Limit (FOL) from the previous level of 25% to the new enhanced one of 40%. This was essentially driven by strong investor demand particularly from international institutional investors, whose confidence in the bank’s strategy and growth ambitions remains high. The increase in FOL comes at a time when the domestic economy has started opening up, as the UAE continues to be a global leader in terms of safety, security and health measures to effectively withstand the impact of the current pandemic.

- The Islamic International Rating Agency (“IIRA”) has recently upgraded its international scale ratings on Dubai Islamic Bank to A+/A1 from A/A1 and national scale ratings to AA (ae)/A1+(ae) from AA-(ae)/A1+(ae). Outlook on the ratings is now “Stable.” The upgrade was primarily the result of the successful conclusion of Noor Bank integration in record time, as well as strong organic asset growth, resilient asset quality, and robust profitability relative to peers. Furthermore, the bank continues to have adequate liquidity, healthy capitalization and a strong retail franchise.

- The Bank is moving forward at an accelerated pace on digitalization to bring in further efficiencies while opening new customer segments. Simultaneously, ESG is a key component of the future strategy and will form an integral part of the growth agenda for 2022.

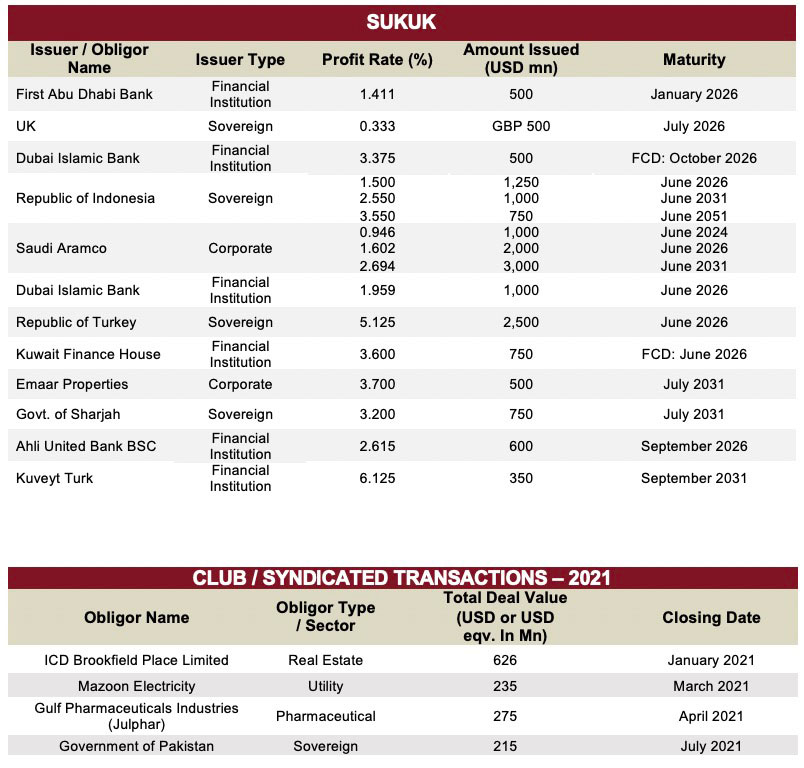

9M 2021 DCM and Syndication Deals

Year to Date Industry Awards (2021)