Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its results for the period ending June 30, 2023.

1H 2023 Highlights:

Management’s comments for the period ending 30th June 2023:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank

Dr. Adnan Chilwan, Group Chief Executive Officer

Financial Review:

Income statement summary

Balance Sheet Summary

Operating Performance

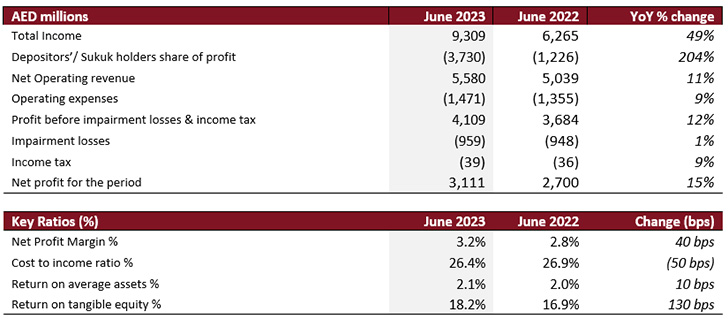

The bank’s Total Income rose to AED 9,309 million in 1H 2023 demonstrating a notable YoY growth of 49% compared to AED 6,265 million primarily driven by strong income from financing assets. This is clearly reflected in the Net Operating Revenue which grew by 11% YoY to reach to AED 5,580 million compared to AED 5,039 million last year.

Pre-impairment profit increased by 12% YoY reaching to AED 4,109 million compared to AED 3,684 million. Impairment charges reached AED 959 million, marginally up 1.2% YoY. However, 2Q 2023 charges of AED 463 million, were down 7% QoQ and 13% YoY.

Operating expenses amounted to AED 1,471 million during 1H 2023 vs AED 1,355 million in 1H 2022, exhibiting 8.5% YoY increase. The bank’s growth plans are well underway including continued enhancements on digital and transactional banking and further improvements on the customer experience journey. Following higher revenue growth and controlled cost growth, cost income ratio strengthened to 26.4%, down 50 bps YoY.

As a result, the bank’s Group Net Profit witnessed a strong increase of 15% YoY to reach AED 3,111 million (the highest in the bank’s history for the period under consideration) vs AED 2,700 million in 1H 2022. Q2 2023 net profit registered AED1,605 million up 6.6% QoQ and 18% YoY.

Net profit margin increased to 3.2% (+40bps YoY) with ROA and ROTE at a healthy 2.1% and 18.2% up by 10 bps and 120 bps YTD respectively.

Balance Sheet Trends

Net financing & Sukuk investments stood at AED 251 billion, up 5.3% YTD from AED 238 billion in FY 2022. DIB’s net financing assets were up by 2% YTD while the Sukuk investments portfolio, another key focus of the bank, expanded by nearly 18% YTD to reach to AED 61 billion.

DIB witnessed healthy overall YoY growth in gross new financing and sukuk in 1H 2023 amounting to nearly AED 45 billion, up 36% compared to AED 33 billion in 1H 2022. Gross corporate financing origination of nearly AED 21 billion (+ 23% YoY) driven mainly by large corporates, while new bookings from consumer financing accounted for AED 10 billion (+19% YoY), continued to exhibit DIB’s competence in deploying financing assets across all segments despite the ongoing market volatilities. Routine repayments of AED 13 billion and AED 8 billion from the corporate and consumer segments respectively kept flowing in given the elevated rate environment. Additionally, excess liquidity in the market led to early settlements from corporates of AED 6 billion. Despite this, net movement in the financing book led to a positive AED 3.5 billion in 1H 2023.

Customer deposits stood at AED 211 billion as of 1H 2023 up by 6% YTD on the back of a 5% increase in corporate deposits and an 8% increase in retail deposits. CASA now stands at AED 81 billion, comprising 39% of deposits. However, on a QoQ basis CASA showed an improvement by AED 1.5 billion. Migration to wakala deposits continued during the period due to the current global rate scenario. This is reflected through an increase in the wakala structure (investment deposits) which is up 16% YTD comprising a higher share of 61% of total deposits versus 56% in YE 2022. Liquidity coverage ratio (LCR) at 159%, up from 150% FY 2022, remains above regulatory requirement, depicting strong liquidity position.

Non-performing financing (NPF) ratio improved to 6.35%, down 11 bps compared YE 2022. Recoveries from NMC and NOOR POCI are ongoing which resulted in a decline of 10% in their NPF accounts. Additionally, coverage ratio on both accounts increased. For NMC coverage increased by 300 bps YTD to 77% and by 800 bps to 36% for the NOOR POCI account. Finally, core DIB NPF account witnessed a 1.2% uptick on a YTD basis to AED 10.9 billion well covered at 84%.

Stage 2 financing increased by 17% YTD to AED 18 billion due to normal flow between stages. On the other hand, Stage 3 coverage accordingly improved to 62.9%, (+170 bps) from FY2022 on the back of a concerted effort on recoveries.

Cash coverage ratio improved to 81% (+300 bps YTD, +700 bps vs 1H 2022) and overall coverage including collateral at 113% (+300 bps YTD and 1,000 bps vs 1H 2022) underpinning DIB’s commitment to enhancing its coverage ratio. Cost of risk on gross financing assets stood at 74 bps compared to 84 bps for the year 2022, an improvement of 10 bps YTD.

Capital ratios continue to remain strong with CAR now at 17.9% (up 30 bps YTD) and CET 1 ratio at 13.4% (up 50 bps YTD), both well above the regulatory requirement.

Business Performance (1H 2023)

Consumer Banking portfolio stood at AED 54 billion up 4% from AED 52 billion in FY2022. The portfolio’s total new underwriting of AED 10 billion during the period increased from AED 8.6 billion in 1H2022. In this, all consumer segments witnessed strong growth particularly auto finance which featured a 30% jump YoY and Personal Finance up 15% YoY in gross new underwriting. The business generated AED 2.4 billion in revenues during the year up a hefty 26% YoY from AED 2 billion during 1H 2022. Blended yield on consumer financing grew by 87 bps YoY to reach to 6.6%. Separately, on the funding side, consumer deposits witnessed an 8% increase YTD to AED 85 billion as investment deposits gained traction from customers while CASA remained steady YTD at AED 49 billion.

Corporate banking portfolio now stands at AED 136 billion up 1.5% YTD driven by automobile, financial institution and the utilities sectors. Gross new wholesale lending for 1H 2023 registered AED 21 billion up 23% YoY, while repayments and early settlements came in at AED 19.5 billion. Revenues featured double digit growth reaching AED 2.3 billion, up 39% YoY compared to AED 1.6 billion in 1H 2022. Yield on corporate financing portfolio expanded by 324 bps YoY to 6.21% compared to 2.97%. Separately on the funding side, corporate deposits increased by 5% YTD while CASA was impacted as large corporate rotate their deposits into investment higher yielding accounts.

Key Business Highlights (2Q 2023)

DCM and Syndication Deals (2023 YTD)

Awards List (2023 YTD)

Dubai Islamic Bank Shareholders Approve 45% Dividend for 2023

Dubai Islamic Bank Full Year 2023 Group Financial Results

Dubai Islamic Bank Unveils 'Nest' – A Breakthrough in Green Living

Dubai Islamic Bank 3rd Quarter 2023 Group Financial Results

Dubai Islamic Bank announces One Tree for Everyone

Dubai Islamic Bank Participates in Ru’ya to Advance Emiratisation Goals